On Tuesday, 11th May, Federal Treasurer Josh Frydenberg handed down the 2021/22 Federal Budget, with a focus on stimulating the domestic economy through measures to better fund the individual taxpayer, increase consumer spending, expand incentive to businesses (allowing them to hire, innovate, and grow), and foster job creation.

Throughout its release, Treasury highlighted the continuing road map to securing Australia’s economic recovery in the wake of the COVID-19 pandemic – acknowledging our strong positioning and on-going progress in comparison to many other global economies.

The 2021/22 Budget outlined the Federal Government’s remit to introduce tax relief for low and middle income earners as well as for small-to-medium businesses, changes to tax rules to help attract global talent and boost the Australian workforce, and Superannuation changes to help individuals and families maximise retirement savings.

In this blog, we breakdown the main measures released as part of the Morrison Government – Federal Budget: 2021/22.

| Individuals |

Low & Middle Income Tax Offset

This years’ Budget highlighted the extension of the Low & Middle Income Tax Offset for the 2021-22 Income Year, first introduced as part of last October’s Federal Budget.

Under the proposed changes, the following tax offsets will be extended:

- A LMITO of $255 for taxpayers with a taxable income of $37,000 or less;

- For taxpayers with a taxable income between $37,000 - $48,000, the LMITO increases at a rate of 7.5 cents per dollar to the maximum amount of $1,080; and

- For taxpayers with a taxable income from $48,000 to $90,000 are eligible for the maximum LMITO of $1,080.

The LMITO is a non-refundable tax offset that provides tax relief for low and middle income taxpayers. Around 10 million individuals will benefit from retaining the offset across 2021-22, with taxpayers receiving this as a lump sum when filing your Tax Returns at the end of each Financial Year.

No Change to Individual Tax Rate Cuts

The Government has announced that there will be no new changes to any Individual Tax Rates, having brought forward the Stage Two – Tax Rates to 1 July 2020 as part of the 2020/21 October Budget. As previously legislated, Stage Three – Tax Rates are to still commence from 1 July 2024.

Changes to Individual Tax Residency Rules

Following recommendations defined by the Board of Taxation in 2019, this year's Budget outlined that Government will replace the existing test surrounding tax residency for individuals with a new modernised framework - introducing a new primary 'bright-line' test.

Under the 'bright-line' test, a person who is physically present in Australia for 183 days or more in any income year will be classified as an Australian tax resident.

Where individuals do not meet the primary test, further secondary tests will be required that depend on a combination of physical presence and measure, objective criteria.

The new rules will come into effect following Royal Assent from Parliament.

Childcare Subsidy

As announced ahead of Tuesday’s Budget release, the Government has highlighted its commitment to more affordable childcare and supporting return to work opportunities for women, providing changes to the Child Care Subsidy.

Effective from 1 July 2022, the Child Care Subsidy will increase by 30% and apply to a family’s second child (and subsequent children) five years and under. The policy will offer a capped rebate of up to 95%.

Self-Education Expensing

The Government will remove the exclusion of the first $250 of deductions for prescribed courses of education. This measure applies for the Financial Year commencing after Royal Assent.

Medicare Levy

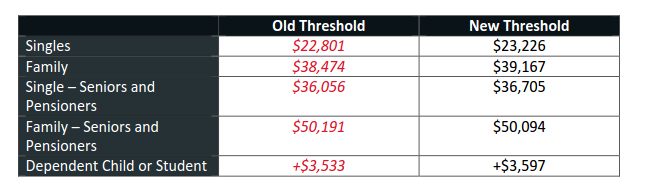

The Government will increase the Medicare Levy low-income thresholds for singles, families, seniors and pensioners for the 2021 Income Year (as outlined below):

Support for Australians to Purchase their First Home

The New Home Guarantee Scheme will be extended to offer a further 10,000 places in 2021-22, specifically for first home buyers to build a new home or purchase a newly built home with a minimum 5 per cent deposit. This measure is also aimed at driving jobs in the construction industry. The Government also announced a new measure aimed at providing support to single parents with dependents.

From 1 July 2021, the Family Home Guarantee will offer 10,000 eligible single parents with dependents the opportunity to build a new home or purchase an existing home with as little as 2 per cent deposit. The scheme is open to first home buyers, as well as previous owner-occupiers.

| Businesses |

Extension of Temporary Full Expensing for Assets

As part of this year’s Budget, the Government announced the extension of ‘Temporary Full Expensing for Assets’ until 30 June 2023.

First introduced in the 2020/21 Budget, the support package allows for eligible businesses with an aggregated annual turnover less than $5 billion the ability to deduct the full cost of the eligible depreciating assets acquired from 7:30PM AEDT on 6 October 2020.

The scheme outlines that the outright deduction may also be available for the cost of improvements to existing eligible depreciable assets during the full expensing period. Additionally, small-to-medium sized businesses can fully deduct second-hand assets purchased and installed during the eligible period.

Extension of Temporary Loss Carry Back Scheme

Likewise, the Government has announced the extension of the ‘Temporary Loss Carry Back Scheme’ until 30 June 2023.

First introduced alongside the Temporary Full Expensing support program, the ‘Loss Carry Back’ scheme allows for eligible businesses to carry-back tax losses from the 2022-23 Income Year to offset previously taxed profits as far back as the 2018-19 Income Year.

The provision of the scheme aims to continue to support previously profitable businesses, who now find themselves in a loss position due to the COVID-19 pandemic.

Employee Share Scheme

As part of the Government’s commitment to support businesses, the ‘cessation of employment’ taxing point for tax-deferred Employee Share Schemes (ESS) will be removed. This change will apply to ESS interests issued from the first income year after the date of Royal Assent.

Through the proposed removal of ‘cessation of employment’, the new measure will result in tax being deferred until the earliest of:

- in the case of shares, when there is no risk of forfeiture and no restrictions on disposal;

- in the case of options, when the employee exercises the option and there is no risk of forfeiting the resulting share and no restriction of disposal; and

- the maximum period of deferral of 15 years.

This introduction aims to help Australian companies to engage and retain the talent they need to compete on a global stage, consistent with recommendations from the Global Business and Talent Attraction.

Introduction of Patent Box tax regime - Medical Technology & Biotechnology Patents Income

A special highlight announced focuses on the introduction of a so-called "patent box" tax regime. This program will tax corporate income derived from patents at a concessional effective corporate tax rate of 17 per cent.

The “patent box” will apply to income derived from Australian medical and biotechnology patents.

Under its introduction, the Government will consult with industry before settling the detailed design of the patent box. Alongside this, consultation will also be made on whether a patent box would be an effective way of supporting the clean energy sector.

Digital Economy Strategy - Self-Assessing Effective Life - Intangible Assets

As part of the Government’s Digital Economy Strategy, the Budget outlined a commitment to provide $1.2 billion over six years from 2022 to support Australia to be a “leading digital economy and society” by 2030.

Under the strategy, the Government will allow taxpayers to self-assess the tax effective lives of eligible intangible depreciating assets, such as patents, registered designs, copyrights, and in-house software.

The above measure will apply to assets acquired from 1 July 2023, following the conclusion of the ‘Temporary Full Expensing’ program. It is also important to note that businesses will have the option of applying the existing statutory effective life to depreciate these assets.

No Change to Company Tax Rate

Similar to the Individual Tax Rate cuts, this year's Federal Budget confirmed that there will be no new changes to the already legislated Company Tax Rates.

From 1 July 2021, the rates will be reduced to 25% for businesses with a turnover less than $50 million.

Support for Job Training & Skills Development

The Federal Budget announced a further investment in job training and skills development. Under the extension of the JobTrainer scheme, an additional 163,000 places will be made available on subsidised training courses – with specific concentration given to digital skills and courses for new aged-care workers.

The Government has also committed to spending an additional $2.7 billion on the extension and expansion of the ‘Boosting Apprenticeship Commencements’ wage subsidiary. This expenditure is expected to help an extra 70,000 people access apprenticeships, on top of those made available through the Budget announcement in October 2020.

Tax Exemption for Eligible Grants involving Storm & Flood Affected Areas

The Government will provide an income tax exemption for qualifying grants made to primary producers and small businesses affected by storms and floods in Australia.

Eligible grants (under Disaster Recovery Funding Arrangements 2018) relate to the storms and floods throughout Australia that occurred due to rainfall events between 19 February 2021 and 31 March 2021. These include small business recovery grants of up to $50,000 and primary producer recovery grants of up to $75,000. The grants will be made non-assessable non-exempt income for tax purposes.

| Superannuation |

Superannuation Contributions - Work Test

The Superannuation Contributions ‘work test’ exemption will be repealed for voluntary non-concessional and salary sacrificed contributions for those aged 67 to 74 from 1 July 2022.

As a result, from 1 July 2022, individuals aged 67 to 74 will no longer be required to meet the work test when making, or receiving, non-concessional superannuation contributions (including under the bring-forward rule) or salary sacrificed contributions.

It is important to note that access to concessional personal deductible contributions for individuals aged 67 to 74 will still be subject to meeting the work test.

Superannuation Guarantee - New Changes

The Government will remove the Superannuation Guarantee $450 per month eligibility threshold from 1 July 2022. As a result, employers will be required to make quarterly Super Guarantee contributions on behalf of such low-income employees earning less than $450 per month (unless another Super Guarantee exemption applies).

The measure will have effect from the start of the first financial year after Royal Assent.

Additionally, the Superannuation Guarantee will increase to 10% from 1 July 2021. This rate will then increase by 0.5% per year until it reaches 12% on 1 July 2025.

Extending access to Downsizer Contributions

From 1 July 2022, the minimum age for the downsizer contribution will be lowered from 65 to 60. This will allow Australians nearing retirement to make a one-off, non-concessional contribution of up to $300,000 per person (or $600,000 per couple) when they sell their family home.

It is important to note that the contribution is subject to existing conditions, which are as follows:

- either the individual or the spouse must have owned the home for at least 10 years' and the property was a main place of residence at at point during this time;

- the sold property must be in Australia and excludes caravans, mobile homes, and houseboats;

- a downsizer contribution must be made to the Superannuation Fund within 90 days of settlement of sale;

- you can't have previously made a downsizer contribution to Super;

- a Downsizer Contribution Form must be submitted to your Super Fund before, or at the time of making your contribution; and

- the downsizer contribution will count towards your transfer balance cap - currently set at $1.6 million.

First Home Super Scheme to be Extended

The Budget confirmed that the maximum amount of voluntary superannuation contributions that can be released under the First Home Super Saver (FHSS) scheme will be increased from $30,000 to $50,000.

To be eligible, a person must be 18 years or over, have not used the FHSS scheme before and have never owned real estate property in Australia. Withdrawals of eligible FHSS contributions (and associated earnings) are taxed at the individual's marginal rate less a 30% tax offset.

Currently, the FHSS scheme allows for future voluntary contributions up to $15,000 per year (and $30,000 in total) to be withdrawn for a first home purchase.

Changes to SMSF Residency Rules

This year’s Federal Budget highlighted the Government’s proposal to relax residency requirements for Self-Managed Super Funds (SMSFs) of Australians living overseas.

The proposed changes include:

- extending the central control and management test safe harbour from two years to five years for Self-Managed Super Funds; and

- removing the active member test for SMSFs and small APRA-regulated funds

By introducing these changes, the measure aims to enable overseas members to continue to contribute to their Australian SMSF without penalty, and ensure similarity with members of large APRA-regulated funds.

The measure will have effect subject to Royal Assent.

| Support for Industry |

Small Brewers & Distillers

As previously announced ahead of Tuesday’s Budget release, from July 2021, eligible brewers and distillers will be able to claim a refund on any excise they pay to an annual cap of $350,000.

Under the current tax relief package, brewers and distillers are entitled to a rebate of 60 per cent of the excise they pay, up to an annual cap of $100,000.

The relief is aimed to help 600 smaller brewers and 400 distillers across Australia to continue to invest in their development, build for growth and create new employment opportunities within the sector.

For More Information

For more information on 2021/22 Federal Budget and it will impact you, please contact your Archer Gowland Redshaw adviser on (07) 3002 2699 or (07) 3221 4004.

%20-%20HubSpot%20(1).png)